Jack Ma, Alibaba CEO, said: “E-commerce will become a ‘traditional business’”. The two small e-commerce companies become two technology giants today. In 21th, the e-commerce has completely changed the way people shop. With one click, your favorite clothes will deliver to your house. With the rapid development of the internet, the global e-commerce will usher in a higher development climax. Alibaba and Amazon, both as top global e-commerce companies, are changing our lives step by step. With a smart kindle, you can watch any books you want. With Alexa, you can turn off your lights by voice control. With Alipay, you don’t have to carry a wallet when you make a payment in China. In this article, the business and profit model of the two companies will be discussed. Including the comparison of the market shares, I hope you will have a clearer understanding of those two e-commerce giants.

Jack Ma, Alibaba CEO, said: “E-commerce will become a ‘traditional business’”. The two small e-commerce companies become two technology giants today. In 21th, the e-commerce has completely changed the way people shop. With one click, your favorite clothes will deliver to your house. With the rapid development of the internet, the global e-commerce will usher in a higher development climax. Alibaba and Amazon, both as top global e-commerce companies, are changing our lives step by step. With a smart kindle, you can watch any books you want. With Alexa, you can turn off your lights by voice control. With Alipay, you don’t have to carry a wallet when you make a payment in China. In this article, the business and profit model of the two companies will be discussed. Including the comparison of the market shares, I hope you will have a clearer understanding of those two e-commerce giants.

Video-For those who are not familiar with company Alibaba. “What is Alibaba?” Explained by Wall Street Journal

They are Tech Companies

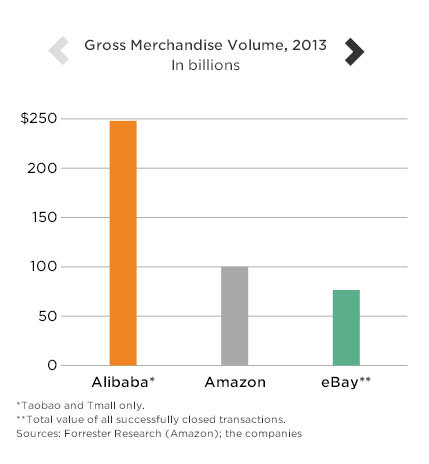

Maybe you would be unfamiliar with Alibaba, a company from China, but if you were a stock investor, you most likely heard of Alibaba’s stock (symbol: BABA), which was listed on the NYSE on September 2014. Alibaba, founded by Jack Ma in 1999, is the world’s biggest e-commerce platform.  It is defined the biggest because Alibaba has a market share of 26.6% while Amazon with a share of 13% ranked second. It is undoubtedly that the population of China contributes a significant number to the market. On the other hand, Amazon (AMZN), founded by Jeff Bezos in 1995, is the largest U.S retailer, just surpassed Wal-Mart, the previous biggest retailer, in 2015. Although two companies are winning the e-commerce market in their countries, Alibaba and Amazon don’t like people call them the e-commerce company. Amazon’s CTO said that “Amazon is a technology company. We just happen to do retail”

It is defined the biggest because Alibaba has a market share of 26.6% while Amazon with a share of 13% ranked second. It is undoubtedly that the population of China contributes a significant number to the market. On the other hand, Amazon (AMZN), founded by Jeff Bezos in 1995, is the largest U.S retailer, just surpassed Wal-Mart, the previous biggest retailer, in 2015. Although two companies are winning the e-commerce market in their countries, Alibaba and Amazon don’t like people call them the e-commerce company. Amazon’s CTO said that “Amazon is a technology company. We just happen to do retail”

Admittedly, they prefer the public to call their Internet &technology company. The biggest reason behind is both companies also offer cloud service. Amazon is the first company who create Amazon web service (AWS), a two-year lead than Google. In fact, many people don’t know that AWS is an important driver of Amazon’s profitability. According to Amazon’s 2017Q1(First Quarter) earning, Amazon’s half of revenue was from AWS. Alibaba starts its cloud service late. However, due to China’ rapid market growth and demand, Alibaba is now the fastest-growing cloud company. They also have one thing in common: both stocks have an excellent performance with a consistent uptrend, clearly showed through below year-to-date stock performance

Admittedly, they prefer the public to call their Internet &technology company. The biggest reason behind is both companies also offer cloud service. Amazon is the first company who create Amazon web service (AWS), a two-year lead than Google. In fact, many people don’t know that AWS is an important driver of Amazon’s profitability. According to Amazon’s 2017Q1(First Quarter) earning, Amazon’s half of revenue was from AWS. Alibaba starts its cloud service late. However, due to China’ rapid market growth and demand, Alibaba is now the fastest-growing cloud company. They also have one thing in common: both stocks have an excellent performance with a consistent uptrend, clearly showed through below year-to-date stock performance

Business models

Alibaba and Amazon have very different business models. Alibaba has several branches. 1688.com focus on business to business trade, similar to online wholesale market; Taobao.com is Alibaba’s biggest shopping site. It uses business to consumer (B2C) model, which the main buyer is individual, while the seller may be an individual or a retailer (think as eBay). Tmall.com is similar to Taobao.com, but the main seller is the brand retailer. The entry threshold is very high because Tmall.com has absorbed high-quality sellers from Taobao to regulate its operations, so the product quality and after-sales services are better than Taobao, just as you shopping at the retail store. However, the operating cost at Tmall.com might not be as lower as the cost at the physical store. Those above are main services from Alibaba.

Since its inception, Amazon has been building its own e-commerce infrastructure and warehouses, integrating its own platform. The latest fulfillment center in Melbourne, Australia is now open in 2018. In 2005, Amazon announced the creation of Prime membership, attracting many loyal subscribers with free two-day shipping. In addition, Amazon’s own product line is also more and more abundant, such as Kindle, Alexa, etc. As the biggest retailer in the U.S, they would only pick the supplier which satisfy their expectations. From the business model perspective, Alibaba is more like a service-oriented company, while Amazon focused on the retail industry.

Profit models

Because of the different business models, they focus on, it also creates a very different profit model (see below figure). As of the third quarter of 2017, Alibaba had 488 million active consumers, 9.89 million sellers, by this large amount of number, so Alibaba makes more profit by charging advertisements and services fee to merchants than retail or wholesale.

Amazon’s profit model is to rely on self-employed businesses to attract buyers, collecting membership fee, and reinvesting most of its revenue to the innovation of new products and service lines. Don’t forget that AWS service is also a big guy in Amazon’s earning. Even though annual financial reports indicate that Amazon has not been profitable from 1995 to 2002, Amazon is still investing and expanding as much as possible with high free cash flow, which is the essential part of the company’s true value; Hard work eventually pays off. Amazon ceases to lose and begin to turn out a profit in recent years. This model of Alibaba, compared with Amazon, does not need to invest much in the construction of logistics facilities, and it doesn’t need to build its own warehouse. Instead, Alibaba successfully builds its own business ecosystem, cooperating with millions and millions of sellers.

Future

Future is also the key to the competition. For business people, they would pay more attention to company’s market shares in their territories. The statistics showed that in 2014, 80% of China’s online shopping market is dominated by Alibaba. (Source: CLSA) However, since other competitors of Alibaba are growing quickly, only 56.7% of China’ online shopping market belongs to Alibaba in 2017. Although Alibaba’s profit margins haven’t shrink yet, it is hard to predict that what is Alibaba’s market share in the next few years. On the other side, Amazon’s market share in the e-commerce market was 37%. Specialists projected it will increase to 50% by 2021. Since Amazon’s domestic competitors are very limited, you can imagine how Amazon is dominating the U.S online shopping market.

India and Southeast Asia will be the main battlefield between Alibaba and Amazon. Amazon brings the traditions into the Indian market, establishes its own warehouses, and enhances Amazon’s local competitiveness. Now, Amazon’s market share almost catches up the local e-commerce giant Flipkart’s market share. Alibaba wanted to use this as a starting point for internationalization. Because of the lack of experience in foreign markets, Alibaba prefers to invest the local holding company, such as Flipkart, Paytm, Snapdeal. In addition to e-commerce, the same situation will occur in cloud computing and logistics, even automated staffless shop.

- Read more about Staffless Shop Comparison: Amazon Go vs Alibaba Tao Cafe

- Read more about Amazon FBA service vs Alibaba Cainiao Logistic Delivers

- Read more about Amazon AWS service vs Alibaba Cloud

Conclusion

Every e-commerce giant is constantly refreshing its own selling records, and we have created an illusion that the more they sell means the more company earn. Now, you understand this doesn’t apply to every e-commerce company, because Alibaba mainly makes the profit by charging the service fee from sellers, and Amazon makes the profit from the retail business. In fact, those differences depend largely on the differences in national conditions too. In conclusion, we have to admit that both companies are great and innovative. People call that the stock market is a weather forecast for the company. Undoubtedly, both investors have high expectations for the two companies. In the end, I hope that these two companies all have a bright future, delivering a better shopping experience to people all over the world.