The innate desire to seek financial freedom has caused investment to be a crucial part of a stable financial future. With various investment opportunities available, it can be challenging for inexperienced investors to make informed decisions about where to put their money. As a student beginning my investment journey, I stumbled upon the realm of REITs. Approaching a new topic naturally left me with a plethora of questions including: What are REITs? How is investing in REITs different from stocks and direct real estate? What are the pros and cons to REITs? And most importantly, should I consider investing in REITs?

What are REITs?

According to the United States Securities and Exchange Commission, REITs, otherwise known as Real Estate Investment Trusts are companies that own income producing commercial property. When an investor invests into REIT firms they get to own a small percentage of the properties. Additionally, REITs differentiate themselves from other forms of investments due to their unique regulations and benefits which NAREIT further discusses in the following video below.

Why Not Direct Real Estate Investing?

Arguably, the immediate question that prompts is why would someone choose to approach real estate in the form of REITs rather than direct real estate investment. In a survey I conducted, the large majority of investors point out the time and money advantages that come with REITs. As one can imagine, purchasing and managing your own property, whether it is to lease, sell, or flip, requires the investor to start out with a large sum of money in addition to the constant maintenance they would have to manage. A Forbes article highlighted the monetary consequences these timely cost poses as well. When it comes to flipping houses, over 40% of investors end up making no profit, resulting in an inefficient use of time and effort. However, this is not to claim that direct real estate investment can’t hold strong value in an individual’s portfolio. Rather it all depends on an investors’ risk preference and strategy.

Comparison to Stocks

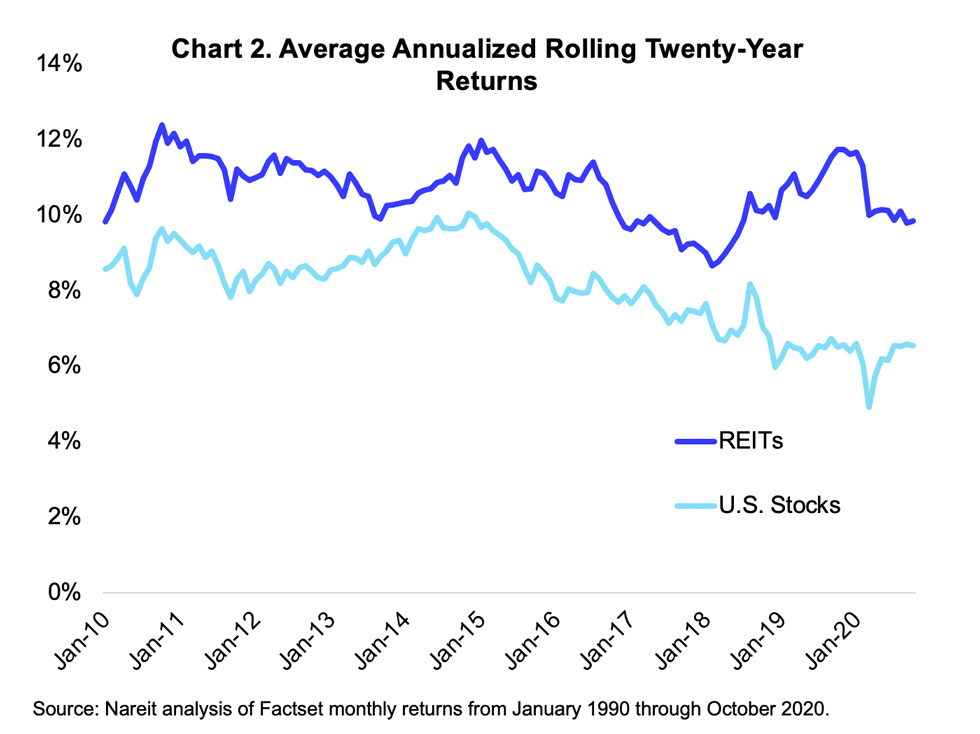

Over the years, REITs have shown greater returns than stocks for various reasons. The FNRP reported that the S&P 500 averaged 2.4% less returns than the NAREIT index annually. Reasons for this phenomenon could largely be accounted for by the REIT firms’ legal requirement to distribute 90% of their taxable income. In addition, REIT firms are often referred to as inflation hedges due to their ability to withstand the volatility of the market in inflationary periods.

Conclusion

Real estate investment trusts (REITs) offer a compelling investment opportunity for investors who want to enter the real estate market without the demands of owning physical property. While there are many benefits that may cause someone to prefer REITs over other strategies of investments, individuals should be aware that REIT investments still possess risks. Thus, rather than pooling all of their funds into one form of investment, a balance for portfolio diversification will yield the most ideal returns. As I continue to expand my understanding of the global markets, I hope to continue to dive deeper into the real estate investment trust industry, a perfect combination between the interest in finance and real estate.