Introduction

During my first 3 years in Highschool, I wasn’t really sure what I would want to do for my future in college. This always stressed me out, but in my last year in Highschool, I knew that I needed to at least get a grasp of what I might want to learn for my years in college. I always had an interest in the field of business because I wanted to learn how all the rich people in the world made their money and I wanted to be like that so that I wouldn’t have to worry about stuff like being able to afford things I need in the future so here I am. I learned about Baruch from my parents and one of my co-workers who went to this school, and they told me that Baruch is one of the best business schools in New York, so I knew that Baruch is where I’ll be heading to start my journey into the world of business.

Real Estate Investment Trusts (REITs): A Safe, Tangible, and Profitable Investment Option

Looking to invest in real estate without the hassle of managing properties? It’s time to consider Real Estate Investment Trusts (REITs), a reliable and potentially more profitable alternative that allows you to invest in real estate without the headaches. But why choose REITs over the stock market or direct property ownership? Here are some compelling reasons.

Steady income streams

Unlike stocks, which can be volatile and unpredictable, real estate investment trusts (REITs) offer investors a more reliable and consistent source of income through dividends. This makes them a more desirable option for those seeking a steady stream of passive income. According to the National Association of Real Estate Investment Trusts, REITs generate income by renting out their properties and distributing this income to their shareholders as dividends. They are required to pay out a minimum of 90% of their taxable income to shareholders, but many choose to pay out all of it (Nareit, Par.6). This means that investors can rely on REITs for a consistent stream of income, as long as the basic properties are generating rental income.

Portfolio diversification

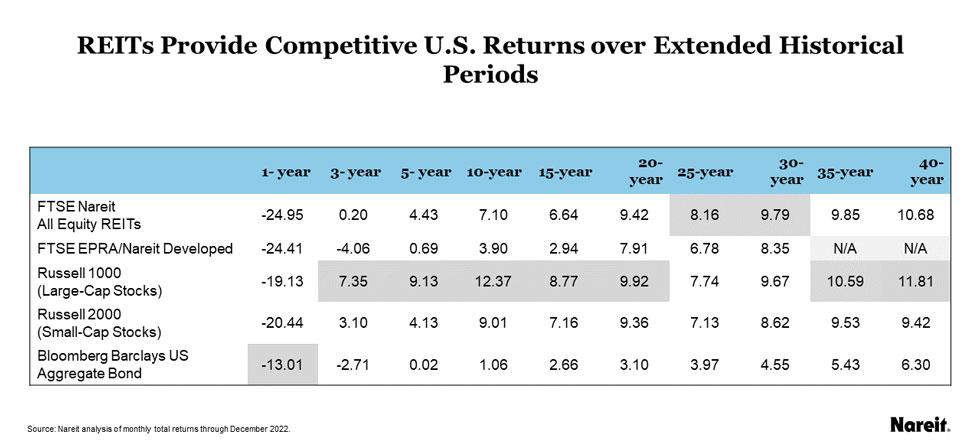

Real estate investors may see REITs as an attractive option for investors looking to diversify their portfolios and mitigate risks associated with investing in individual properties or stocks. REITs provide exposure to a diversified portfolio of real estate assets, which helps to spread the risk and reduce the overall volatility of an investment portfolio. This highlights the potential benefits of including REITs in an investment portfolio. Furthermore, as Yildiray Yildirim notes in an interview, investors should invest in both, to lower the risk against the market downturn and to diversify their portfolios (Yildiray Yildirim, 2023). The diversity of REITs means that investors can benefit from access to different types of properties across many locations, rather than being tied to a single property or region.

Tangible assets

Considering that REITs are physical assets, they allow investors to acquire and hold something tangible, unlike stocks which are more intangible. This tangibility makes REITs a safer investment option compared to stocks, which are subject to market changes and other factors outside of an investor’s control. Real estate investing allows investors to acquire property that can increase in value over time, providing a sense of security and stability that is not there in stocks. In addition, Beth Mattson-Teig notes, REITs are favored by retail investors due to their growing demand for shares and tendency to be long-term holders, which can help dampen share price volatility (Beth Mattson-Teig, 2018, Par.5).

Conclusion

In conclusion, REITs offer a more stable alternative to stocks. They provide investors with a way to indirectly invest in real estate and generate income through rental payments, which are then distributed to shareholders as dividends. The diversified nature of REITs can help investors lower the risks that come with investing in individual properties or stocks. By investing in a diversified portfolio of real estate assets through REITs, investors can benefit from higher average returns with less volatility and access to a wide range of properties and locations. So, if you’re looking for a safe, tangible, and profitable investment option, REITs may be the way to go.

Disclaimer: This is not financial advice. These are just my thoughts based on my findings.