The financial dimension of your life is defined by how you are doing financially. Ask yourself a few questions about your financial health: Do you have a roof over your head? Do you have food to eat? Do you have clothes to wear? Those are the basics. More advanced financial health would focus on your career, your income, you savings, your investments etc.

Let’s say you own a retail store; your sales start to decline; you don’t have money for new inventory or fresh merchandise; you are stuck with stale goods, old styles etc; People come to shop and see the same old merchandise on the shelves, and walk out. You are in a “rut”. Sales continue to decline, but you still have to pay the rent and the payroll; you run a ‘sale’ which cuts into your profits, but still don’t have enough money to pay the fixed expenses. The cycle continues until you finally decide to give up and close the store.

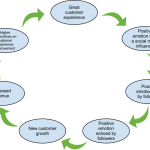

A virtuous cycle in retail can start with a sharp-looking store and good advertising. People come to shop and like the merchandise. You sell out and buy more; shoppers come back and see new, fresh goods on the shelves. Employees are excited to come to work in a hot store that shoppers love…. The store cycles you into prosperity.

Another Example: You are short on cash; so you get a credit card (or two); now you start incurring debt; before you know it you are being charged interest, then late penalties when you can’t afford to pay the bills; This leads to less financial stability; you have even less cash, and just like that – you’re in a vicious debt spiral!

The opposite of this spiral can happen as well. On an individual level, saving money and not spending unless you can really afford it, leads you to be able to make better investments and earn more income, and have more choices… that is a virtuous cycle.

The proverbial “rich can get richer” because they usually have better access to money, better access to good investments, better resources to earn better returns etc. The cliché: “money comes to money” can be very true indeed.

<< Previous page Next page>>

Financial health is important. Whether it deals with people or countries, a weak economy will have a domino effect. When the financial crisis of 2008 started, everything was going bad. Bad mortgages lead to the market crashing from the mortgage backed securities, homes weren’t selling and people owned more than the value of the home was, unemployment increased, and other negative themes soon followed. Regarding people, bad financial health will lead to bad physical health. A person might lose their job and be homeless or seek drugs as an exit. Thus, maintaining strong financial health is beneficial.

Without economic stability, low and middle-income families will be struggling with jobs and effects of the market. An example of this would be the 2008 stock market crisis, which created housing mortgages to significantly increase interest rates. Many people these days are saving money in order to maintain their finances but are still having a hard time finding employment opportunities. I believe that the economy will face a similar crisis like this in the future. Therefore, we must act when that time comes.

This presentation really made me look at life in another way which I would never have considered before. Although people say money doesn’t buy happiness, having financial stability is important in maintaining a balance in that part of your life. As we learned in the presentation, having a deficiency in one area can start a vicious cycle and affect other parts of your life.